In any country, tax relief is an essential part of tax management as it helps individuals and businesses reduce taxable income and optimize their financial planning. By understanding the available tax reliefs and claiming them effectively can lead to significant tax savings. In this guide, we’ll be covering the key reliefs available, including how to claim them, and how Worksy’s HRMS can streamline tax management for your business.

First Step: Understanding Tax Relief in Malaysia

Tax relief refers to specific deductions that reduce taxable income, allowing taxpayers to pay less in taxes. Here, the Malaysian government provides various tax reliefs to encourage beneficial financial habits such as saving for education, investing in retirement, and maintaining good health.

What Are The Available Tax Reliefs?

- Individual and Dependent Relief (Amount: RM9,000): Automatically granted to all individual taxpayers to account for personal living expenses.

- Medical Expenses for Parents (Amount: Up to RM8,000): Covers medical treatments and special needs for parents, provided that these expenses are certified by a medical practitioner.

- Education Fees for Oneself (Amount: Up to RM7,000): Applies to courses in approved fields such as law, accounting, science and technology. There is an additional RM2,000 available for up-skilling courses.

- Lifestyle Relief (Amount: Up to RM2,500): Covers the purchases of books, magazines, computers, tablets, sports equipment, gym memberships and internet subscriptions.

- Childcare Fees (Amount: Up to RM3,000): Covers fees paid to registered child care centres or kindergartens for children aged 6 years and below.

- Private Retirement Scheme (PRS) Contributions (Amount: Up to RM3,000): Encourages retirement savings by providing tax relief on PRS contributions.

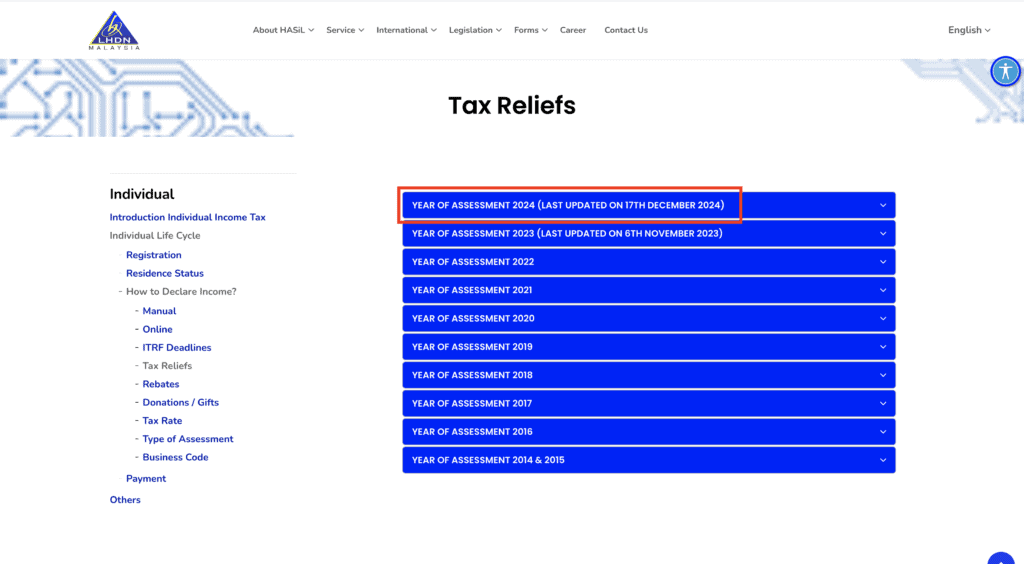

For more detailed information and full list of tax relief, refer to LHDN’s official list here.

Simplify Your Tax Management with Worksy’s HRMS:

Manually managing taxes can be time-consuming and prone to errors. With Worksy’s HRMS, it simplifies your tax management through automation and compliance features, ensuring that your business is up to date with the latest statutory requirements.

Worksy’s Payroll and Compliance Modules is Equipped with:

- Automated Payroll Processing: Ensures accurate salary calculations, tax deductions, and EPF/SOCSO contributions.

- Tax Compliance Features: Auto-generates tax forms such as PCB, EA Forms, and CP39.

- Employee Self-Service Portal: Employees can access payslips and tax-related documents anytime.

Learn more about Worksy’s payroll solution and how it can enhance your tax management now.

Tips For Claiming Tax Relief Effectively

Join thousands automating payroll and HR with local compliance built-in.